Roof-Top Solar (“RTS”): The Changing Regulatory Landscape In Vietnam (2025)

July 04, 2025

Highlights

|

|

|

President Emmanuel Macron’s official visit to Vietnam from May 25 to 27, 2025 resulted in the French Development Agency (“AFD”) signing a €67 million financing agreement[1] for funding the National Power Transmission Corporation (“EVNNPT”). This agreement aims to support the expansion and modernization of Vietnam’s electricity transmission network. The signing of this partnership paves the way for numerous opportunities for foreign investors, especially with Vietnam having established a robust legal framework to accommodate such investments.

BACKGROUND: RENEWABLE ENERGY COMMITMENTS IN VIETNAM

Four years ago, during COP26, Vietnam’s Prime Minister Pham Viet Chinh announced a “net-zero target” for Vietnam. It was a commitment to bring Vietnam’s net emissions to zero by 2050 and was reaffirmed at the COP 28. Vietnam has committed to scale up the percentage of renewables in its energy production mix and to mobilize both public and private investment into renewable and clean technologies.

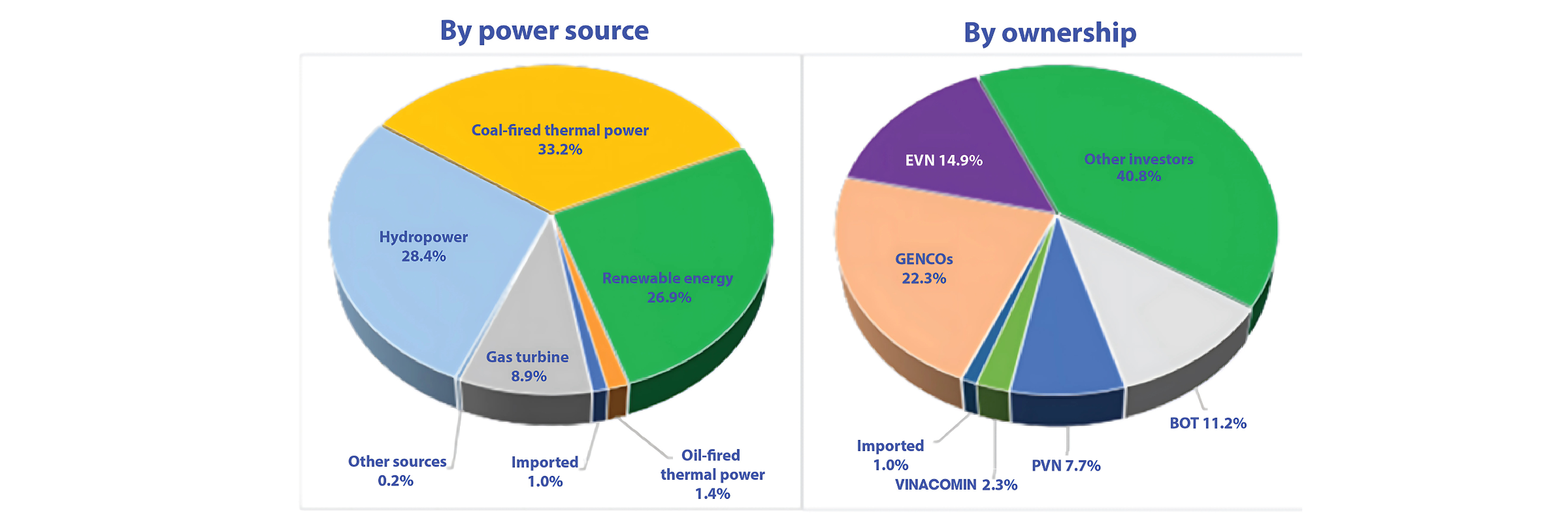

In addition to these international commitments, Vietnam is a preferred investment destination for many of the largest Multinational Corporations (“MNCs”), including Apple, Samsung, Intel, and Nvidia. The Electronics and green technology industries account for approximately 63% of Foreign Direct Investment (FDI) flows, marking a transition to technologically advanced, skill-intensive production.[2] These companies, along with nearly all reputable MNCs, are signatories to the RE50 or RE100, which provide a corporate guarantee under the auspices of the United Nations, that a company will source between 50%-100% of its electricity from renewable energy sources by the middle of the 21st century (i.e., 2050). Many companies will be unwilling to expand investment in Vietnam, and others will relocate, unless they witness Vietnam making genuine progress towards developing renewable Energy projects. Currently, fossil fuel dominates the energy mix in Vietnam, with approximately 55%[3], while wind power, solar power, and hydro-electric sources together account for around 45%[4] of the country’s power supply-mix.

Title: Structure of power source capacity of the entire power system in 2023

Source: en.evn.com.vn

ROOF-TOP SOLAR (RTS): A POTENTIAL SOLUTION FOR VIETNAM’S INDUSTRIAL SECTOR

The regulatory climate is quite challenging for renewable energy projects in Vietnam in terms of approval and acceptance by the Vietnamese regulators. However, Roof Top Solar (“RTS”) offers a bridge to meeting the RE50 and RE100 requirements because it provides a practical mechanism to create financially bankable and viable financing documentation. Also, from a practical perspective, RTS may be a solution to the ongoing brown-out/black-out issues resulting from insufficient baseload capacity in Vietnam.

During the heat wave of 2023, the authorities demanded a 50 percent reduction in electricity consumption to address supply problems, halting activity of certain manufactures in Bac Ninh province for more than 24 hours.[5] RTS could definitively be a solution to provide and supply the electricity needed in Industrial Zones so there will be no more significant losses in productivity.

THE REGULATORY REGIME FOR ROOF-TOP SOLAR IN 2025

Since the middle of 2024, the entire legal framework for Vietnam’s electricity sector, in general, and RTS power, in particular, has been continuously evolving. New regulations governing RTS now include: (i) The Electricity Law No. 61/2024/QH15, effective February 1, 2025 (“Law on Electricity 2024”); (ii) Decree No. 57/2025/ND-CP dated March 3, 2025 (“Decree 57”); and (iii) Decree No. 58/2025/ND-CP dated March 3, 2025 (“Decree 58”).

The recent changes in law may significantly effect the business models and regulatory practice for development of RTS projects in Vietnam. Depending on the business model of the RTS developers, the development of new RTS projects, and operation of existing projects, may be subject to new permits, approvals, and notification requirements under Decree 57 and Decree 58. As a result, to be bankable, RTS developers may need to review and restructure their business models and regulatory practice for compliance with the new legal framework.

Under the new regulations, RTS developers may only sell to customers that are qualified as large power consumers. Notably, “large power consumers” are defined as consumers with large electricity capacity and consumption according to the regulations of the MOIT. Furthermore, (former) Decree 80/2024 on Direct Power Purchase Agreements (“DPPA”) defined large consumers as those consumers who average at least 200,000-kWh per month over the last twelve months. Also, pursuant to Decree 57, the framework in (former) Decree 80 appears to still exist at the 200,000-kwh threshold.

Decree 57 is the most important of the new regulations. It stipulates the conditions for selling excess electricity generated by RTS plants and connecting to the national grid—meanwhile Decree 58 focuses on self-production and self-consumption of energy. Sales of electricity must not exceed 20% of the production of a renewable solar power system, and the price of excess electricity is the average market price of the preceding year announced by the relevant regulatory agencies (e.g., MOIT, etc.).

Also, Decree 57 establishes mechanisms for direct electricity trading between renewable energy businesses and large electricity consumers. This is the most interesting point for RTS investors (foreign or local), the excess output by RTS can be sold to a subsidiary of the Electricity Power Corporation of EVN.

While Decree 58 provides important details on the application of the Law on Electricity 2024, there is a subtle point to be made about Decree 58: the sale of excess electricity produced by RTS’ is supposed to be limited to a maximum of 20% of production capacity. However, the sale of excess electricity output is unlimited in mountainous, border and island areas.

CONCLUSION

The regulatory regime for renewable energy has adapted well to the commitments made by Vietnam, as illustrated by the evolution in its regulation of the sector. The decrees open up new prospects for investors, both domestic and foreign.

Vietnam’s energy sector is at a crucial juncture, driven by its climate commitments to the world and the need to meet growing demand from both domestic industry and investors. The introduction of the new Electricity Law and accompanying regulations – Decrees 57 and 58 – marks an important step towards modernizing the regulatory framework, prioritizing national energy security, and promoting a competitive and transparent electricity market. These reforms encourage market-driven solutions and the adoption of green energy.

The recent agreement between the French Development Agency (“AFD”) and the National Power Transmission Corporation (“EVNNPT”) underlines the country’s openness to FDI and its determination to modernize essential infrastructure. This commitment is essential if Vietnam is to attract and retain MNCs, many of which need solid access to renewable energy to meet their Corporate Social Responsibility (“CSR”) targets.

Roof Top Solar (RTS) emerges as a pragmatic solution for bridging the gap between Vietnam’s current dependance on fossil fuels and its long-term renewable energy targets. While regulatory hurdles remain, RTS offers industrial consumers a means of mitigating the risks of power failures and blackouts, ensuring a degree of business continuity and productivity. The new legal framework, although complex, provides clearer guidance for RTS project developers and large consumers, facilitating direct power purchase agreements and enabling the sale of excess electricity under defined conditions.

As Vietnam continues to refine its regulatory environment and expand its renewable energy capacity, the country is positioning itself as a leader in Southeast Asia’s energy transition. The convergence of legal clarity, international investment, and technological innovation promises to accelerate the shift toward a sustainable, reliable, and competitive energy future.

Image: © GIZ

[1] See, e.g., https://www.vietnam.vn/en/evnnpt-va-afd-ky-thoa-thuan-mo-rong-hien-dai-hoa-luoi-truyen-tai-dien (last visited June 5, 2025)

[2] See, e.g., https://www.vietnam.vn/en/viet-nam-thu-hut-lan-song-moi-ve-dau-tu-vao-cac-nganh-co-gia-tri-cao (last visited June 5, 2025).

[3] See, e.g., https://angeassociation.com/location/vietnam/ (last visited June 4, 2025).

[4] See, e.g., https://www.vietnam-briefing.com/news/vietnams-new-electricity-law-legal-framework-renewable-energy.html/ (last visited June 5, 2025)

[5] See, e.g., https://www.france24.com/en/live-news/20230616-vietnam-s-power-crisis-hits-local-firms-foreign-investors (last visited June 5, 2025)

If you have any questions, please contact our lawyers below:

For more information, please contact YKVN Marketing Team:

T: (+84-28) 3 822 3155

marketing@ykvn-law.com